This week in our series, we share with you examples of how successful financial services companies have used performance marketing techniques to drive their online business. These are techniques we feel can help you upgrade your digital marketing strategy and in turn power your business.

This week in our series, we share with you examples of how successful financial services companies have used performance marketing techniques to drive their online business. These are techniques we feel can help you upgrade your digital marketing strategy and in turn power your business.

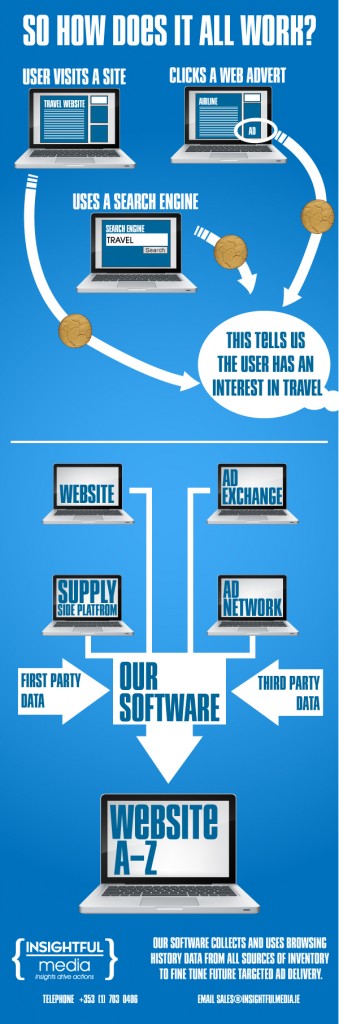

Below we outline some of the key concepts in performance marketing – including Real Time Bidding, Prospecting and Retargeting – and analyse how they can be best introduced by companies operating in the financial services world.

Performance Marketing helps you target the right customers for your business – extending your online audience reach and converting online interest into new clients.

Savvy businesses across all areas of the financial services industry have applied these techniques to improve marketing efficiency, and thus, lower their CPA .

Case Study: 1

Client Industry: Life Insurance

Techniques: Real Time Bidding and Lookalike Prospecting

This technique explained:

Background:

A leading broker of term life insurance with a keen focus on ROI has successfully grown by leveraging several marketing channels, including print, TV broadcast, radio, SEO and SEM. These strategies were all working well, but they wanted to accelerate growth, and recognized the need to expand online

Solution:

The client wanted to build a custom audience targeting strategy to reach online consumers with the same profile as their current highest value customers. The process combined a sample of the client’s high value customer data (first party data) with its own 40 offline consumer data sources (third party data). This model was then used to identify more than 100 predictive factors that defined a high value “lookalike” prospect for the advertiser. This information was used to execute an audience targeting campaign using real-time bidding (RTB) exchange media where bidding strategies could be optimised as the campaign progressed.

Results:

New leads produced by the campaign converted at double the overall company average.

The lifetime value (LTV) of these new customers were 60% greater than average.

The company realized a 186% ROI from the campaign.

Further Reading:

http://www.tru-signal.com/sites/default/files/file/TruSignal-Leading_Life_Insurance_Broker.pdf